Greed or Inflation? An Economic Analysis of LEGO Price Increases

/Today’s BrickNerd article features a guest post by Michael A. Craven, Ph.D., edited by Dave Schefcik, analyzing LEGO’s upcoming pricing changes. Dr. Craven is an Assistant Professor of Accounting at the Marist College School of Management.

The price of LEGO sets is going up on August 1st (some as much as 25%), much to the chagrin of the AFOL community. Why is LEGO increasing the prices of existing sets on shelves at a time when people could use a little break financially instead? In their press release on the increases published by Brickset, LEGO cited “increased raw material and operating costs” which implies that inflation is driving the decision. However, inflation can also be a convenient cover by some companies for raising prices to increase profits.

In this article, I will conduct an economic analysis of the LEGO price increases to determine what motivated them, if they are justified, and what impact they will have on the LEGO community. Based on that analysis, I can also reasonably predict the upcoming price changes for sets that haven’t been announced yet. So let’s take a deep dive into LEGO’s pricing strategy and structure.

Inflation and Increasing Prices

Before we talk about LEGO, we need to learn a bit about inflation. Inflation is a natural consequence of the use of money in an economy and occurs for two reasons. The first is an increase in the money supply (the amount of money in an economy). This increase does not change the amount of goods or services available, and so buyers will “bid up” the price on what they purchase. The other reason (and the one relevant to this article) is the increase in costs to produce goods and services. These cost increases are mostly passed on to consumers, and so the fixed amount of money that exists in people’s pockets is not able to buy as many goods or services as before. Regardless of why it happens, inflation reduces the purchasing power of money or the amount of goods and/or services it can buy.

Businesses respond to cost-driven inflation by raising the prices they charge to their customers. Most of us have undoubtedly experienced this at the grocery store because the small margins on food products necessitate frequent price changes to adjust for rising costs. These price adjustments occur to maintain the value received and keep the business profitable. However, prices may also be “sticky” because consumers dislike paying more money for the same product and because there are costs related to changing prices.

These are known as “menu costs” among economists in reference to the costs necessary for restaurants to print new menus when they change prices. Therefore, any price increases that a company makes on existing products must not only account for inflation but also for the other costs related to actually making the price changes. (Another way around this is “Shrinkflation” where companies provide slightly smaller goods at the same price as before in an attempt to disguise the price increase, though when LEGO fans closely judge sets by size and piece count, this is harder to pull off. That’s an article for another day.)

LEGO’s business model is an interesting example of price-stickiness and the menu cost problem. A LEGO set is only on store shelves for a limited time, and until now, each set had typically been offered at a fixed price for its entire life. Assuming some level of inflation, a LEGO set always loses a little value for LEGO in the time from when it is introduced to when it is retired. Thus, it is true that LEGO has, “for some time, … absorbed these costs to keep pricing stable” as they stated in their press release. The question that remains is why the current business environment or market conditions are sufficient to make LEGO take the drastic step of increasing the price of existing sets already on shelves rather than just introducing higher price points on newly introduced products. Couldn’t they have just waited to introduce higher prices with new products and let the older sets retire?

Why This Year Is Different

To investigate why LEGO is changing prices on existing sets now, we will begin by taking a look at inflation. The higher rate of inflation at the current time compared to historical rates could explain why LEGO is willing to pay the “menu costs” to increase its prices now when they haven’t previously. To illustrate this point, we will consider several sets and their inflation-adjusted value both at launch and when they were retired.

In the table below, I’ve selected six pairs of LEGO sets including one currently-available set and a set from a previous time that was similar in theme, minifigures, and piece count. I’ve then calculated what the price would have been if the initial sales price was adjusted for inflation over the length of the time the set was available for purchase. The analysis is limited to USD and prices in US markets, although the effects of inflation should be similar in other countries.

For those interested in the methodology, the inflation adjustment for the price of each LEGO set is made using the Consumer Price Index (CPI) from the Bureau of Labor Statistics (BLS). Information for the LEGO sets including the original price and the launch and retirement were obtained from the Brickset database. The monthly CPI information was used to calculate the inflation rate between the month the set was launched and the month it was retired (or July 2022 for those sets still currently available), and it was used to calculate the inflation-adjusted value of the set at its retirement (or currently).

| Set Number |

Set Name |

Launch Date |

Retirement Date |

Original Price |

Inflation Adjusted Price |

Total Loss of Value |

Loss per Month |

|---|---|---|---|---|---|---|---|

| 76208 | The Goat Boat | 4/26/2022 | Current | $49.99 | $51.49 | 2.92% | 0.95% |

| 76038 | Attack on Avengers Tower | 1/3/2015 | 12/31/2016 | $59.99 | $61.97 | 3.20% | 0.13% |

| 10297 | Boutique Hotel | 1/1/2022 | Current | $199.99 | $211.83 | 5.59% | 0.81% |

| 10224 | Town Hall | 1/3/2012 | 12/31/2014 | $199.99 | $207.18 | 3.47% | 0.10% |

| 76388 | Hogsmeade Village Visit | 1/9/2021 | Current | $79.99 | $91.06 | 12.16% | 0.65% |

| 4757 | Hogwarts Castle | 5/4/2004 | 12/31/2005 | $89.99 | $93.66 | 3.91% | 0.19% |

| 42130 | BMW M 1000 RR | 1/1/2022 | Current | $229.99 | $243.61 | 5.59% | 0.81% |

| 8258 | Crane Truck | 1/8/2009 | 12/31/2011 | $149.99 | $160.31 | 6.44% | 0.18% |

| 75300 | Imperial TIE Fighter | 1/1/2021 | Current | $39.99 | $45.53 | 12.16% | 0.64% |

| 7150 | TIE Fighter & Y-wing | 2/22/1999 | 12/31/2000 | $49.99 | $52.89 | 5.46% | 0.24% |

| 43187 | Rapunzel's Tower | 1/8/2022 | Current | $59.99 | $69.25 | 13.37% | 0.43% |

| 41146 | Cinderella's Enchanted Evening | 6/1/2017 | 12/31/2018 | $39.99 | $41.37 | 3.34% | 0.14% |

As you can see from the inflation-adjusted prices, the value (in terms of purchasing power) lost to inflation over the life of the set can be calculated. Additionally, because LEGO sets are available for different periods of time, this is normalized by averaging the loss of value per month over the life of the set.

This data begins to reveal a pattern about LEGO prices and the effects of inflation on currently available sets. Although all sets lost some value due to inflation, the currently-available sets lost significantly more value. The sets from previous time periods lost between 0.10% and 0.24% of their value per month. The sets that are currently available have lost between 0.43% and 0.95% of their value per month. To put that in perspective, The Goat Boat (76208) has lost almost as much value (2.92%) in the three months it has been available as Attack on Avengers Tower (76038) did (3.20%) in the entire two years it was available from 2015 through 2016.

Inflation in the United States has been higher than usual throughout 2021 and 2022, and June 2022 saw the highest year-over-year inflation in over 40 years (BLS). The usual rate of inflation is between 2% and 3%, which is consistent with all of the other years of LEGO set data. Current inflation is about three to four times that level, and that is also consistent with the effects of inflation on the currently-available LEGO sets.

UNited States Monthly INflation rate from 2018 to June 2022 via TradingEconomics.com

This finding indicates that LEGO is essentially willing to absorb the effects of inflation up to 6% to 7% of the value of the set without changing the price of sets. However, many of the sets currently available have exceeded that threshold and will continue to be available (and lose value) in this high-inflation environment. LEGO has already announced that it will be increasing prices on some existing sets, so we know that inflation is now high enough for them to accept the costs of making those changes (including the negative reactions from the LEGO community).

Are LEGO’s Price Increases Excessive?

LEGO has announced its price increases with the explanation that it is adapting to inflation. However, in today’s day and age, consumers are wary of companies raising prices to not only account for inflation but also increase their profit margins. This is more likely for staples like food and gasoline, but it would still be possible for LEGO to increase profits under the guise of inflation.

Thanks to some U.S. retailers revealing early price listings, we know some of the planned price changes to existing LEGO sets. Although this is most likely not comprehensive, this data can be used to evaluate whether these price increases are linked to inflation or are inherently excessive. These new prices can be compared to the inflation-adjusted original prices (using the same CPI data) to evaluate whether or not the new prices are reasonable in the current environment.

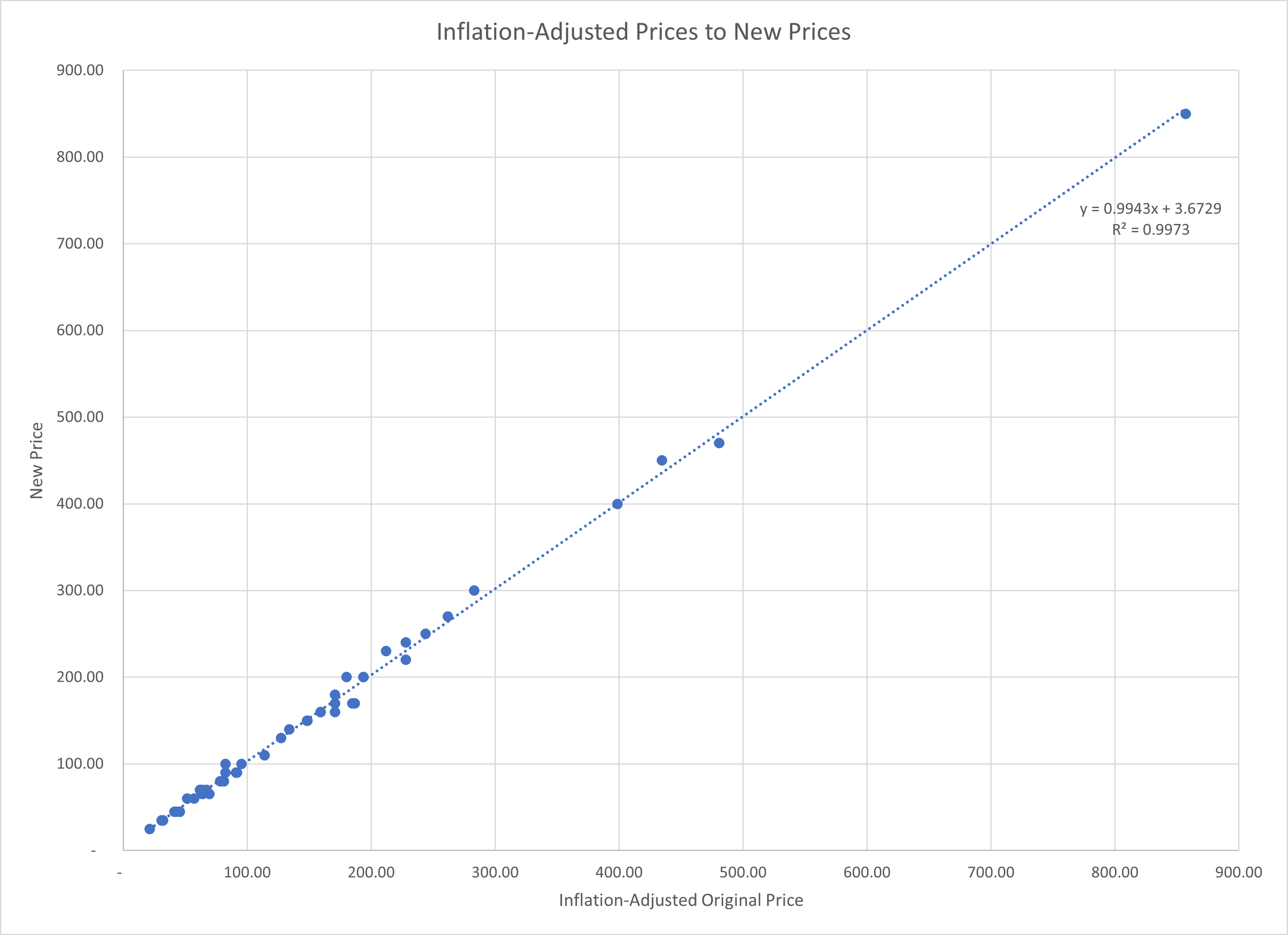

If the planned price increases are simply adjusting for inflation, the new prices should match the inflation-adjusted original prices. (This assumes that LEGO accounts for inflation when it sets prices and that adjusting for inflation similarly accounts for future inflation.) Representing this data graphically provides a simple way to evaluate this assumption. If the inflation-adjusted price matches the new price, the graph should be of a perfect diagonal line with a slope of 1.

From this graph, we can see that the new prices for these sets almost precisely match the original prices adjusted for inflation. A simple regression model predicts a slope approaching 1 (at 0.9943) with the inflation-adjusted original price able to predict 99.73% of the variation in the new price. This strongly suggests that LEGO has based its price increases almost entirely on inflation. Additionally, some slight variation from the inflation-adjusted values should be expected given that LEGO prices are whole-dollar amounts constrained to certain price points. If those price variations are random (and not an effort to increase profit), it should be expected that about half of them fall above the line and half below, which appears to be the case.

Setting new prices in a high-inflation environment brings up another important issue, which is the amount of time that a LEGO set will remain on the market at the new price. For sets that may be retired in the near future, there is little incentive to increase their price because there will not be much time to recover the costs of changing the price (and the loss of value has already been absorbed for the most part).

For sets further from retirement, there is a greater incentive to increase the price, and a larger price increase may be warranted to account for expected high levels of inflation in the near future. Therefore, we can hypothesize that 1) sets farther from retirement are more likely to receive a price increase and 2) that price increase is likely to be greater than the inflation-adjusted price. The retirement date of any specific LEGO set is not entirely certain, but the longer a LEGO set has been available should be a fairly reliable indicator of how close it is to retirement. To test this hypothesis, we can model the percentage that the new price exceeds the inflation-adjusted original price against the amount of time that the set has been available for sale.

From this mapping, it becomes apparent that the newer sets (that can be assumed to be farther from retirement) generally have price increases in excess of inflation and that the older sets generally have price increases that are lower than inflation would suggest. This is consistent with the hypothesis that newer sets would receive greater price increases to account for future higher-than-normal inflation. A regression model can be estimated for the percentage of difference in the new price to the inflation-adjusted original price and the natural log of the months since launch (this transformation is typical to compare nominal data to percentage difference data). This model accounts for 59.01% of the variation in the new price from the inflation-adjusted price based on the amount of time the set has been available.

Assuming that LEGO sets have about a two-year life cycle, we can consider some reasons for the differences in the price changes above or below the inflation-adjusted original price. The newest sets (out for less than one year) should be expected to be on shelves for an additional year or more, and so they would need a larger increase to keep their value in the high-inflation environment without another price increase. The sets nearing the two-year mark since release show a smaller but above-inflation increase, and this may be because they are likely to see one additional holiday-shopping season to recoup their decrease in value before they retire.

Sets still being sold after more than two years are a bit of a mystery as they are much fewer in number. However, the fact that these sets are receiving a price increase indicates that they should still be sold for some time. The fact that the increase for these sets is below inflation may be because they have already recovered their fixed costs or because larger sets are sold for a longer period of time and are receiving a smaller proportional price increase relative to their higher prices.

The answer here to whether LEGO is being greedy or just trying to keep up with rising costs is that LEGO appears to be responding to inflation and inflation alone in adjusting prices. All of the price increases (that we know so far) are almost perfectly correlated with the inflation-adjusted original price of the set. Typically, prices do not come back down once inflation recedes (prices just stop going up as fast), and so it is reasonable from a business perspective for LEGO to reset these prices now in light of unexpectedly high inflation. Further, those sets which appear to be receiving excess increases relative to inflation are the more recently released sets, which implies a hedge against future high inflation so that prices do not need to be raised again for these sets.

Could LEGO Afford to Keep Prices the Same?

It is clear that LEGO is changing the price of existing sets to account for unexpectedly high present and future inflation. However, the question remains of whether LEGO needs to maintain its profit margin in this way given that they have always absorbed inflation in the past. To answer this question, we will need to consider whether their profit margin is enough to absorb this higher-than-normal inflation and what other impacts that not changing prices may have.

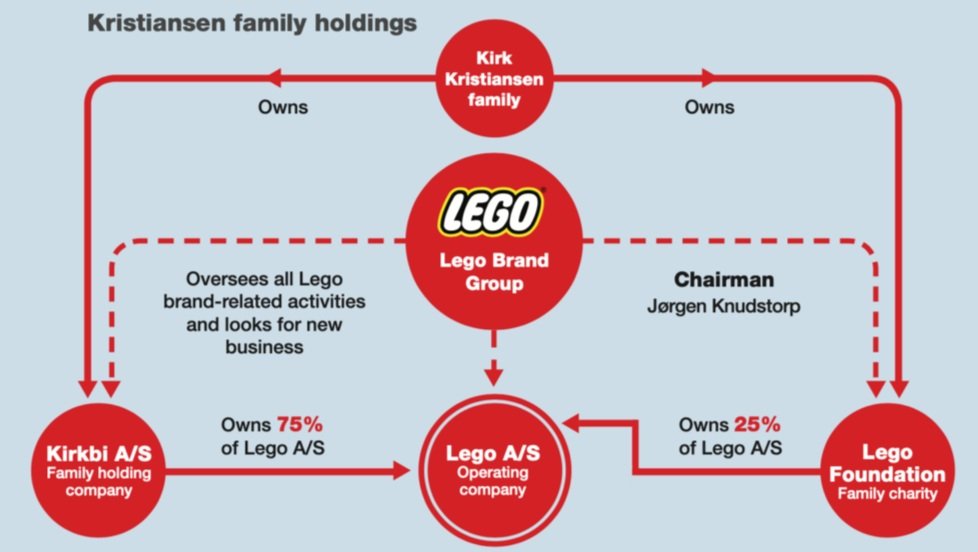

The LEGO Group had a profit margin of 24.0% for 2021 with profit margins around 22% from 2017 through 2020 (LEGO Group 2021 Annual Report). This may seem high compared to the profit margin of some of their competitors like Hasbro at 6.8% (Hasbro, Inc. 2021 Annual Report), but the structure of the LEGO Group does not make this a good basis for comparison. As a private company, the profits of the LEGO group must not only be sufficient to allow for future investments (like most other companies) but also provide funds for the Kirkbi family holding company and the LEGO Foundation.

LEGO ownership chart via CMG Partners

While it appears that the LEGO Group might have just barely enough profit margin to absorb inflation in the current environment, there are other factors at play. Considering our table of comparisons from earlier, the current loss to inflation on sets released in January of 2022 is about 12% and the usual total loss of value to inflation is around 3%. If inflation continues at its current pace through 2023, these sets are likely to lose about 20% of their value to inflation in total by the end of 2023. This would leave LEGO with a real profit margin around 6-7% (after accounting for the normal 3% level of inflation). This level of profit is probably not sufficient to maintain the programs of the LEGO Foundation and other investment projects at their current levels.

There are two additional complications to this analysis that suggest that LEGO will be less able to absorb inflation costs. The first is the fact that inflation is not equal across countries and across products and services. The second is the issue of foreign currency transactions and the impact of fluctuating exchange rates on profitability.

3180 Octan Tank Truck via Amazon

The analyses so far have looked at the average rate of inflation in the United States for all types of goods and services. LEGO is likely to be experiencing increases in production costs greater than this average rate because energy prices are a significant driving force of current inflation (and the raw material for most LEGO bricks is a petroleum derivative). Therefore, it is quite possible that the increase in material costs alone would have forced sets to be sold at a loss anyway if the prices were not changed. Additionally, because the planned price increases are consistent only with average inflation up to the time of the increase, it appears that LEGO is actually absorbing some of the excess cost increase.

The other complication here is that of foreign currency transactions and related uncertainty. LEGO, like most other large multinational companies, takes steps to reduce the risks associated with changes in foreign currencies that are needed for their transactions in other countries. Although these hedges tend to wash out over time, LEGO is currently in a negative position on both their Euro- and U.S. Dollar-denominated futures due to the strength of the Euro and the Dollar at the present time (LEGO Group 2021 Annual Report). These negative positions reduce the financial flexibility that The LEGO Group might otherwise be able to use to absorb additional inflation costs.

PHOTO CREDIT: LITTLE BIG ART/ANDY MORRIS

One final, non-financial consideration for changes in prices lies in the price setting for the next cycle of LEGO sets. The concern of inflation is not about whether prices will rise but about how fast they are rising. If LEGO were to wait and absorb the current inflation, the change in prices for sets coming out next year would likely feel extreme. Consumers are able to recognize inflation in the moment but tend to do a poor job equating inflation-adjusted value over time. Therefore, LEGO faced the difficult decision of 1) raising prices and losing consumer goodwill but not losing financial value, or 2) losing financial value and potentially still losing that goodwill when prices of future sets were significantly increased to account for past inflation. By adjusting the price of sets now, they should be able to maintain a relatively standard level of pricing for future sets while managing customers’ expectations.

For these reasons, The LEGO Group is not in a position to absorb the costs of inflation to be able to keep the prices of currently-available sets the same. Raising prices so abruptly is fairly unprecedented in LEGO history, but it is reasonable given nearly unprecedented levels of inflation. From a business perspective, it is logical that LEGO should take this action whenever inflation is a threat to its financial stability. However, it has taken the highest inflation in over forty years to bring us to this point, so we can hope that this is a once-in-a-lifetime occurrence.

Predicting Price Changes

LEGO has not yet released the list of new price points for sets (EDIT: they now have), but some educated guesses can be made with the data available. The models developed to assess the relationship between inflation and the new price points for sets could also be used to predict the price changes for sets that were not listed early. Taking a look at the same graph as above, the new price points for sets is related to both the inflation-adjusted value of the original price point and also the amount of time the set has been available. This means that we can reasonably predict what price increases to expect on all current sets if they are adjusted for inflation according to the model.

Again for the math nerds, using the regression model derived in Excel to test the associations of the data, the new price point for LEGO sets outside the original dataset can be predicted. The regression model of y=-0.059*ln(x)+0.1778 provides a prediction for the percentage that a set’s new price will exceed its inflation-adjusted original value, where “x” is the number of months that a set has been available. Multiplying the inflation-adjusted original price by 1 plus the resulting percentage from the regression formula provides the prediction for the new price of the set.

Below I’ve compiled a sampling of sets and what the model predicts their inflation-adjusted price could be in August. (A complete listing of all of the currently-available sets represented in the Brickset database and the predictions for their new prices can be found in this Google Sheet I created: LEGO Inflation Price Comparisons and Predictions). This table lists the original price of the set, the inflation-adjusted original price, a known new price (if applicable) along with the amount of the increase, and both a raw and rounded prediction of each set’s new price based on the formula above.

The rounded predictions approximate the LEGO pricing model in full dollar increments ending in $xx.99. Based on a survey of LEGO price points, any set with a predicted value less than $20 was rounded to the nearest whole dollar, less than $50 was rounded to the nearest $5, less than $700 was rounded to the nearest $10, and any predicted value in excess of $700 was rounded to the nearest $50.

Here is the selection of current LEGO sets that could receive price increases in specific ranges according to my model:

| Set Number & Link |

Set Name | Launch Date |

Original Price |

Inflation Adjusted Price |

Predicted Price (Raw) |

Predicted Price (Rounded) |

Predicted Total Increase |

|---|---|---|---|---|---|---|---|

| 75192 | Millennium Falcon | 1/10/17 | $799.99 | $981.02 | $909.90 | $899.99 | $100.00 |

| 75252 | Imperial Star Destroyer | 1/10/19 | $699.99 | $828.14 | $790.00 | $799.99 | $100.00 |

| 10294 | Titanic | 8/11/21 | $629.99 | $685.78 | $707.35 | $699.99 | $70.00 |

| 10276 | Colosseum | 11/27/20 | $549.99 | $629.38 | $628.60 | $629.99 | $80.00 |

| 75978 | Diagon Alley | 1/9/20 | $399.99 | $461.73 | $449.49 | $449.99 | $50.00 |

| 42143 | Ferrari Daytona SP3 | 1/6/22 | $399.99 | $423.67 | $450.90 | $449.99 | $50.00 |

| 51515 | Robot Inventor | 10/15/20 | $359.99 | $411.70 | $409.52 | $409.99 | $50.00 |

| 71040 | Disney Castle | 1/9/16 | $349.99 | $439.92 | $403.70 | $399.99 | $50.00 |

| 10284 | Camp Nou - FC Barcelona | 1/9/21 | $349.99 | $398.44 | $399.68 | $399.99 | $50.00 |

| 75290 | Mos Eisley Cantina | 1/10/20 | $349.99 | $404.02 | $393.33 | $389.99 | $40.00 |

| 71741 | NINJAGO City Gardens | 1/2/21 | $299.99 | $341.52 | $342.33 | $339.99 | $40.00 |

| 76178 | Daily Bugle | 1/6/21 | $299.99 | $341.52 | $342.47 | $339.99 | $40.00 |

| 31203 | World Map | 1/6/21 | $249.99 | $284.60 | $285.39 | $289.99 | $40.00 |

| 10273 | Haunted House | 1/6/20 | $249.99 | $288.58 | $280.87 | $279.99 | $30.00 |

| 71374 | Nintendo Entertainment System | 1/8/20 | $229.99 | $265.49 | $258.44 | $259.99 | $30.00 |

| 10274 | Ghostbusters ECTO-1 | 11/15/20 | $199.99 | $228.86 | $228.31 | $229.99 | $30.00 |

| 10283 | NASA Space Shuttle Discovery | 1/4/21 | $199.99 | $227.67 | $228.26 | $229.99 | $30.00 |

| 10278 | Police Station | 1/1/21 | $199.99 | $227.67 | $228.19 | $229.99 | $30.00 |

| 75341 | Luke Skywalker's Landspeeder | 4/5/22 | $199.99 | $206.00 | $226.44 | $229.99 | $30.00 |

| 10279 | Volkswagen T2 Camper Van | 1/8/21 | $179.99 | $204.91 | $205.52 | $209.99 | $30.00 |

| 80039 | The Heavenly Realms | 1/6/22 | $179.99 | $190.65 | $202.90 | $199.99 | $20.00 |

| 10302 | Optimus Prime | 1/6/22 | $169.99 | $180.05 | $191.63 | $189.99 | $20.00 |

| 10265 | Ford Mustang | 1/3/19 | $149.99 | $177.45 | $169.22 | $169.99 | $20.00 |

| 80036 | The City of Lanterns | 1/1/22 | $149.99 | $158.87 | $168.85 | $169.99 | $20.00 |

| 75292 | The Razor Crest | 1/9/20 | $129.99 | $150.06 | $146.08 | $149.99 | $20.00 |

| 10290 | Pickup Truck | 1/10/21 | $129.99 | $147.98 | $148.46 | $149.99 | $20.00 |

| 76408 | 12 Grimmauld Place | 1/6/22 | $119.99 | $127.09 | $135.26 | $139.99 | $20.00 |

| 10266 | NASA Apollo 11 Lunar Lander | 1/6/19 | $99.99 | $118.30 | $112.83 | $109.99 | $10.00 |

| 10289 | Bird of Paradise | 1/6/21 | $99.99 | $113.83 | $114.15 | $109.99 | $10.00 |

| 41450 | Heartlake City Shopping Mall | 1/3/21 | $99.99 | $113.83 | $114.11 | $109.99 | $10.00 |

| 10293 | Santa's Visit | 1/10/21 | $99.99 | $113.83 | $114.20 | $109.99 | $10.00 |

| 31120 | Medieval Castle | 1/8/21 | $99.99 | $113.83 | $114.17 | $109.99 | $10.00 |

| 10298 | Vespa 125 | 1/3/22 | $99.99 | $105.91 | $112.62 | $109.99 | $10.00 |

| 41714 | Andrea's Theatre School | 1/6/22 | $99.99 | $105.91 | $112.72 | $109.99 | $10.00 |

| 76209 | Thor's Hammer | 1/3/22 | $99.99 | $105.91 | $112.62 | $109.99 | $10.00 |

| 76956 | T. rex Breakout | 4/17/22 | $99.99 | $102.99 | $113.92 | $109.99 | $10.00 |

| 71766 | Lloyd's Legendary Dragon | 1/1/22 | $69.99 | $74.13 | $78.79 | $79.99 | $10.00 |

| 71360 | Adventures with Mario | 10/7/20 | $59.99 | $68.61 | $68.19 | $69.99 | $10.00 |

| 71738 | Zane's Titan Mech Battle | 1/1/21 | $59.99 | $68.29 | $68.45 | $69.99 | $10.00 |

| 75306 | Imperial Probe Droid | 4/26/21 | $59.99 | $66.89 | $67.94 | $69.99 | $10.00 |

| 10281 | Bonsai Tree | 1/1/21 | $49.99 | $56.91 | $57.04 | $59.99 | $10.00 |

| 75312 | Boba Fett's Starship | 1/8/21 | $49.99 | $56.91 | $57.08 | $59.99 | $10.00 |

| 10311 | Orchid | 1/5/22 | $49.99 | $52.95 | $56.34 | $59.99 | $10.00 |

| 31129 | Majestic Tiger | 1/1/22 | $49.99 | $52.95 | $56.27 | $59.99 | $10.00 |

| 76832 | XL-15 Spaceship | 4/24/22 | $49.99 | $51.49 | $57.18 | $59.99 | $10.00 |

| 60345 | Farmers Market Van | 1/6/22 | $44.99 | $47.65 | $50.72 | $49.99 | $5.00 |

| 75979 | Hedwig | 1/6/20 | $39.99 | $46.16 | $44.93 | $44.99 | $5.00 |

| 76394 | Fawkes, Dumbledore's Phoenix | 1/6/21 | $39.99 | $45.53 | $45.65 | $44.99 | $5.00 |

| 76950 | Triceratops Pickup Truck Ambush | 4/17/22 | $39.99 | $41.19 | $45.56 | $44.99 | $5.00 |

| 40478 | Mini Disney Castle | 1/10/21 | $34.99 | $39.83 | $39.96 | $39.99 | $5.00 |

| 40516 | Everyone is Awesome | 1/6/21 | $34.99 | $39.83 | $39.95 | $39.99 | $5.00 |

| 76200 | Bro Thor's New Asgard | 1/8/21 | $29.99 | $34.14 | $34.24 | $34.99 | $5.00 |

| 41957 | Adhesive Patches Mega Pack | 1/6/22 | $29.99 | $31.77 | $33.81 | $34.99 | $5.00 |

| 76205 | Gargantos Showdown | 1/1/22 | $29.99 | $31.77 | $33.76 | $34.99 | $5.00 |

| 60304 | Road Plates | 1/1/21 | $19.99 | $22.76 | $22.81 | $24.99 | $5.00 |

| 40550 | Chip & Dale | 1/3/22 | $19.99 | $21.17 | $22.52 | $24.99 | $5.00 |

| 40442 | Goldfish | 1/3/21 | $14.99 | $17.07 | $17.11 | $16.99 | $2.00 |

| 40524 | Sunflowers | 1/1/22 | $12.99 | $13.76 | $14.62 | $14.99 | $2.00 |

| 40220 | London Bus | 1/6/16 | $9.99 | $12.56 | $11.52 | $11.99 | $2.00 |

| 40469 | Tuk Tuk | 1/1/21 | $9.99 | $11.37 | $11.40 | $10.99 | $1.00 |

| 40539 | Ahsoka Tano | 1/1/22 | $9.99 | $10.58 | $11.25 | $10.99 | $1.00 |

| 60344 | Chicken Henhouse | 1/6/22 | $9.99 | $10.58 | $11.26 | $10.99 | $1.00 |

| 76202 | Wolverine Mech Armor | 1/4/22 | $9.99 | $10.58 | $11.26 | $10.99 | $1.00 |

| 60310 | Chicken Stunt Bike | 1/10/21 | $7.99 | $9.10 | $9.13 | $8.99 | $1.00 |

The caveat to these predictions is that LEGO has stated that only one-quarter of sets will be receiving a price increase. Assuming that the list I linked to is comprehensive, that means that 150 sets out of the currently 600 available will be receiving a price increase. Only 55 sets are known to have planned price increases, which means that there are 100 more sets yet to receive price increases. If we eliminate the sets only increasing by $1, there are still more than 500 sets with predicted increases which leave about 450 possibilities for the 100 sets due to actually receive a price increase.

Based on this model alone, there is no way to narrow down which sets are more likely than others to receive price increases. It is entirely likely that those choices are being driven by sales numbers or agreements with intellectual property partners. However, it is likely that we will see price increases on larger sets and sets that are expected to remain available for longer periods of time. I would also expect LEGO is conducting market research to determine what prices consumers will and won’t accept for certain sets in the future.

Conclusion: It’s All About Inflation

To recap, LEGO’s upcoming price increases are not the machinations of a money-hungry company looking to extract every dollar out of their customers and are instead directly a result of unprecedented inflation and hedging against further inflation to come. Because of inflation, the longer a LEGO set sits on store shelves, the more it loses value for the company. So while the rising prices may feel extreme out of context, they are accurately set to adjust for current inflation almost perfectly.

What does that mean for the AFOL community? Well, if you have the desire and ability to purchase any new sets, buy them ASAP and use your VIP points before the price increases take effect after August 1st. And in the unlikely event that we see as high of inflation as in the past year, you could expect LEGO to raise prices on existing sets again in the future. (Personally, I would not expect this any time soon as inflation is the worst it has been in 40 years.) These changes will likely also mean a bit of confusion between prices offered at official LEGO Stores and other third-party retailers. Prices on BrickLink will also likely be in flux as sellers navigate the “new normal.”

LEGO is an expensive hobby—and it will continue to be so. Very soon we could see the first LEGO set that sells for more than $1,000, not just because sets are getting bigger and bigger but also because inflation is pushing prices up more than ever before. So let’s not get out the torches and pitchforks just yet—from an economic perspective, LEGO is doing exactly what they should be doing to continue making plastic bricks.

What do you think of LEGO’s upcoming price increases? Leave your thoughts in the comments below.

Do you want to help BrickNerd continue publishing articles like this one? Become a top patron like Charlie Stephens, Marc & Liz Puleo, Paige Mueller, Rob Klingberg from Brickstuff, John & Joshua Hanlon from Beyond the Brick, Megan Lum, and Andy Price to show your support, get early access, exclusive swag and more.